Personal Financial Management | Skills You Need

Personal finance management is simply the management of money and financial decisions that cover managing your money, savings, spendings, etc. The personal financial management includes budgeting, banking, tax, retirement planning. In simple words, the personal finance management is all about meeting financial goals. Whether it is your retirement planning, short term financial goals, savings for future. All this planning depends on your income, your expenses or spendings and comes up with a plan to fulfill the requirement under your financial constraints. The process of managing personal finance can be summarized in a financial plan.

A. Financial Plan Force You to Budget: When you understand the reality of personal financial planning you will create the budget on a monthly basis. For an effective financial plan, you need to make a budget. Budgeting is the best and only tool for creating or developing a personal money plan.

B. Financial Plan Helps You to Start Planning for Retirement: Personal finance management helps you to create the budget and when you spend according to the budget, you will save more money and it can help you to start planning for retirement. At what age you have to retire, depends on the money you saved.

Determine your current financial situation for that you need to develop a list of your current liabilities. And create financial records that include your bank statements, wills, receipts, bills, insurance policy, etc.

Track your income and expenditures, it helps you to know your spending.

Create your short term or long term financial goal, because the financial planning revolves around goals.

Overview- Personal Financial Management | Skills You Need

- Why Personal Financial Management is Important?

- Types of Personal Finance

- What are Benefits in Personal Finance?

- What are the Two Advantages of having a Personal Financial Plan?

- What is the purpose of finance?

- Personal Financial Management App

- Personal Finance Planning

- Personal Finance Tracker App

- Personal Financial Management Software

- Personal Financial Management Tips

Why Personal Financial Management is Important?

Personal financial management is important in everyone’s life. It is the process of managing your money to achieve personal financial goals. It helps to determine the short and long term financial goals and create a plan to meet the goals. When you have a financial plan it’s easy to make a financial decision and helps you to stay on track to meet your goals.

Types of Personal Finance

Personal finance is a term that covers your savings and investing. It is a type of FINANCE.

Also, finance is defined as the management of money like investing, borrowing, saving, budgeting.

There are three types of finance personal finance, corporate finance, and public finance.

What Are The Benefits of Personal Finance?

There are the following benefits of personal finance-

- The main benefit of personal finance tracking is, it helps to avoid debts. There are a number of peoples who failed to manage their personal finance and end up with high debts.

- By having proper management of personal finance you can save more money for the future.

- Try to reduce the usage of credit cards, so you can save your money.

- The best thing about personal finance management is it helps to save money.

- No one can predict when financial emergencies will occur.

- By personal finance tracking, you can easily track your expenses.

What are the Two Advantages of Having a Personal Financial Plan?

Advantages of having a personal financial plan-

B. Financial Plan Helps You to Start Planning for Retirement: Personal finance management helps you to create the budget and when you spend according to the budget, you will save more money and it can help you to start planning for retirement. At what age you have to retire, depends on the money you saved.

What Is The Purpose Of Finance?

The main purpose of financial management is to help people to save money, manage money and raise money for the future. It helps you to control the spendings and increase the saving for the great financial future. Finance force you to create a budget on a monthly basis and the budget keeps you on track. It helps to improve your expenses or spending and saves money in a great manner.

Personal Financial Management Tips

Tips to make effective personal financial management-

- To make good and effective personal financial management all you need to create a budget.

- A budget tool that helps you to stay on track and keeps you safe from unnecessary spendings.

- The common tip for personal finance management is to pay yourself first.

- Pay yourself first means you are investing in your financial future.

- Stay away from the debts. Common debts like a house loan, student loan mortgage, etc.

- Some debts are bad like a credit card that is used while purchasing.

- Save the money and be prepared for an emergency.

- We can’t predict the future or any emergency but we can prepare for it.

- Set an emergency fund of 3-6 months living expenses that means if you lost your job.

- Do invest because investing is the best way to increase your net worth.

- Most of the people stay away from investing and saving money in savings accounts.

Personal Financial Management App

Takefin Finance and Expense Tracker App

Takefin Finance and Free Personal Expense Tracker App is a smart app that tracks your spending or expenses. The finance tracker app allows you to add, monitor your every expense. This app is ideal for both business and personal expenses tracking. It is the best app for android and iOS to analyze the expenses.

Personal Finance Planning

Financial planning is the long term process that helps you to achieve your financial goals. It is a big concept that includes budgeting, savings, retirement planning, insurance, and debt.

Determine your current financial situation for that you need to develop a list of your current liabilities. And create financial records that include your bank statements, wills, receipts, bills, insurance policy, etc.

Track your income and expenditures, it helps you to know your spending.

Create your short term or long term financial goal, because the financial planning revolves around goals.

Personal Finance Tracker App

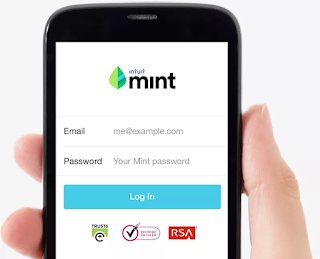

Mint App- Finance Tracking

The mint app is the best personal finance tracker app to control your spendings. This app helps you to connect all your bank accounts, credit cards, and monthly bills. The best thing about this app is it lets you know your due bills and the spendings. It also sends a reminder of your budget if you reach beyond the limit. This app monitors your credit scores in a good manner.

Did you hear there is a 12 word phrase you can communicate to your partner... that will induce intense emotions of love and impulsive attractiveness for you deep inside his heart?

ReplyDeleteThat's because hidden in these 12 words is a "secret signal" that fuels a man's impulse to love, please and protect you with his entire heart...

12 Words That Trigger A Man's Desire Response

This impulse is so built-in to a man's genetics that it will drive him to work harder than before to take care of you.

As a matter of fact, triggering this all-powerful impulse is absolutely important to getting the best ever relationship with your man that the second you send your man a "Secret Signal"...

...You will immediately notice him open his soul and mind to you in a way he haven't expressed before and he will identify you as the one and only woman in the world who has ever truly tempted him.